Strong Passenger Growth and Lower Fuel Prices Boost Airline’s Outlook

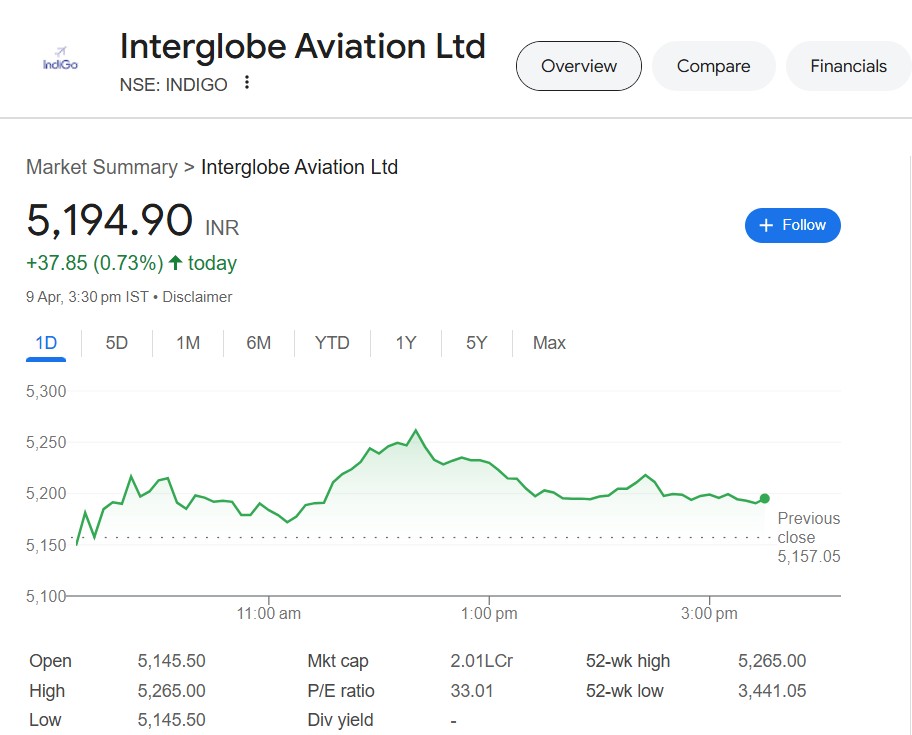

Mumbai, April 9, 2025: Good news for investors in IndiGo! The airline’s parent company, InterGlobe Aviation, saw its share price soar to a record high of ₹5,199.50 during trading on Tuesday. The stock eventually closed at ₹5,157, a healthy gain of 3.4% for the day on the Bombay Stock Exchange (BSE).

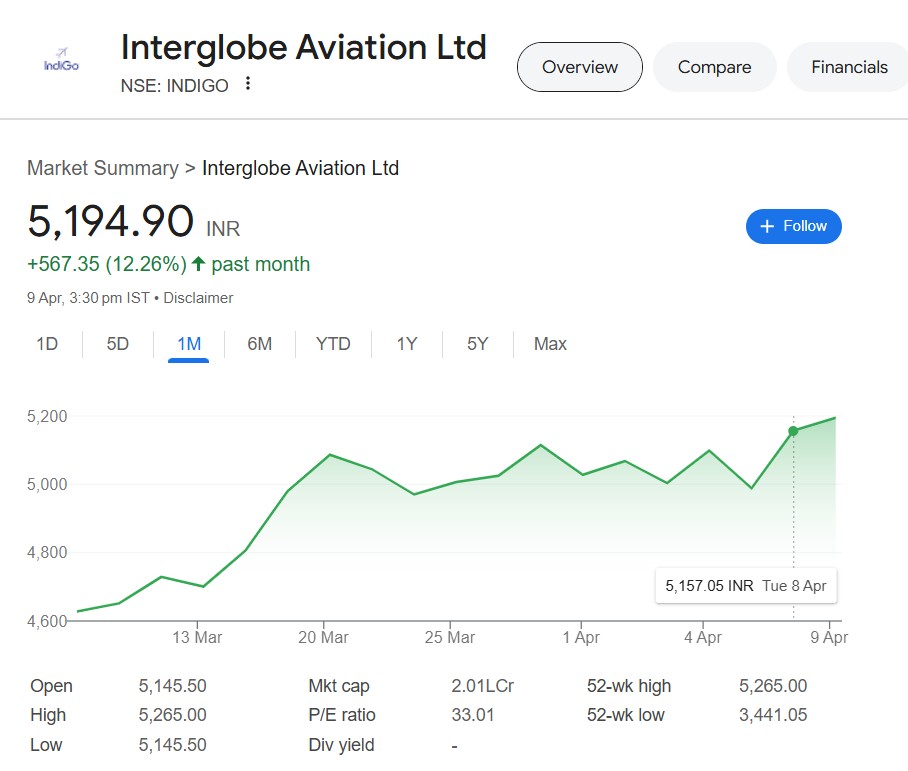

This jump in share price comes as the market has a positive outlook for IndiGo, the largest airline in India. Over the past month, the company’s stock has risen by a significant 12%. This growth is mainly due to expectations of strong passenger numbers in the January-March 2025 quarter (which is the fourth quarter of the financial year 2025) and a welcome drop in the prices of crude oil, which is a major cost for airlines. In comparison, the BSE Sensex, a key indicator of the Indian stock market, only rose by 0.7% during the same period.

Analysts Predict Big Profits for IndiGo in the Coming Months

Experts at ICICI Securities, led by analyst Ansuman Deb, believe that IndiGo is in a sweet spot. They predict that the airline will benefit from a combination of better-than-expected fares, lower crude oil prices, and high passenger occupancy (load factor). Because of this, they expect IndiGo to report a strong net profit of ₹2,300 crore for the fourth quarter. This positive performance is also expected to push the company’s profit before tax (excluding foreign exchange effects) for the entire financial year 2025 to a robust ₹8,600 crore.

The brokerage firm remains very positive about IndiGo’s long-term prospects. They highlight the airline’s cost efficiency, its large number of aircraft on order, and its strong financial position as key advantages. They also believe that the current favorable balance between the number of flights available and the demand from passengers will continue to boost IndiGo’s profitability in the next financial year (FY26).

Emkay Research, in their preview of IndiGo’s fourth-quarter results, also anticipates steady performance from the airline. They also expect that IndiGo will not face any losses due to changes in the value of the rupee against other currencies during this period. Their analysis suggests that IndiGo’s passenger occupancy is likely to improve by 0.7 percentage points compared to last year, reaching 87%. They also predict that the airline’s capacity and revenue will increase by 20% and 21% respectively compared to the same quarter last year. Analysts Sabri Hazarika and Arya Patel from Emkay Research noted that the slight strengthening of the rupee against the dollar would mean no foreign exchange losses, and possibly even small gains, for IndiGo.

In the previous quarter (October-December 2024), IndiGo’s core earnings were flat due to losses from a weaker rupee, higher aircraft leasing costs, expenses related to grounded aircraft, and airport charges. However, the airline’s revenue in that quarter was better than expected, growing by 14% year-on-year, driven by a 13% increase in the number of passengers. IndiGo also achieved new milestones in that period, operating a peak of 2,200 daily flights and serving a record 31.1 million passengers.

The airline’s management is optimistic that this strong passenger demand will continue in the coming quarters. They also expect that the expansion of their cargo operations will further boost their earnings from sources other than ticket sales. IndiGo has indicated a healthy outlook for demand, with their capacity growth in the fourth quarter expected to be 20% higher than the same period last year.

Looking beyond the domestic market, IndiGo is also focusing on international expansion and offering more premium services, which are expected to further drive growth. Kotak Research pointed out last month that the long-haul international market presents a significant untapped opportunity for IndiGo, which could yield substantial gains over time. Their analysts believe that IndiGo has several advantages in this area, including experience from code-sharing agreements, upcoming additions of different types of aircraft, and the strength of its domestic network to feed international flights. Consequently, Kotak Research has increased its valuation for IndiGo, anticipating a 10% increase in earnings for the financial year 2027 from long-haul international travel, compared to their earlier expectation of 5%.

IndiGo currently holds a dominant 62% market share in the Indian aviation sector, making it one of the most efficient low-cost carriers globally. As of December 31, 2024, it had a fleet of 437 aircraft and operated scheduled services to 89 destinations within India and 34 international locations.

#IndiGo #IndianAviation #StockMarket #SharePrice #AirlineNews #PassengerGrowth #MakeInIndia